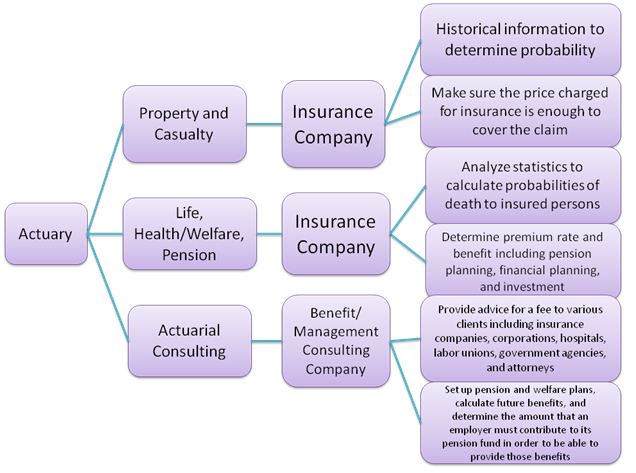

Actuaries assemble and analyze statistics to calculate probabilities of death, sickness, injury, disability, unemployment, retirement, and property loss. They work for insurance companies, consulting firms, government departments, banks and investment firms, public accounting firms or anywhere risk management is needed. Most actuaries specialize in one of the three fields which are listed below.